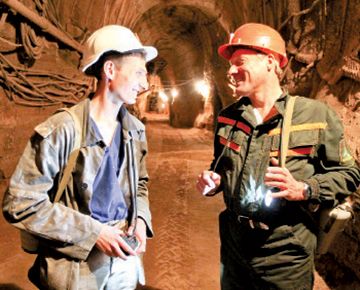

Mining dynasty of father and son Malakhov at Belaruskali JSC

Eighteen months ago, the world potassium market was shaken by scandal no less dramatic than that seen in Shakespeare’s plays. The situation is becoming calmer, although the previous $400 per tonne price is yet to be reclaimed. The former level may be restored some time but companies involved are still registering losses.

Last year, Belaruskali’s potassium fertiliser production stood at 10.3m tonnes: an absolute record and a 50 percent rise on 2013. If such volumes had been produced three years ago, it would have been a ‘golden age’. However, falling prices have resulted in miners working longer hours for smaller yields. Meanwhile, there is some reason for pride, since export revenue rose between January and November 2014, reaching $2.5bn (up 1.7 fold).

With volumes down relative to demand, Uralkali’s old ‘price war’ tactics are no longer of relevance. 2014 was a record year for the company but, at present, losses are more common. The temporary closure of Solikamsk-2 mine is likely to severely affect Uralkali’s finances, since it has been producing up to 18 percent of the company’s total volume. The final decision on its further operation is to be made in spring but, if it fails to reopen, the company’s production will fall to 10.2m tonnes in 2015 (down from at least 12m tonnes in the past).

It appears that Uralkali’s production volumes will soon match Belaruskali’s, making them almost equal players on the global potassium market. Until recently, Belaruskali was the ‘underdog’ but the Russian media now asserts that the Belarusian Potassium Company is ‘taking revenge’ for former discord, engaging in predatory pricing. Of course, our traders are pursuing the strategy imposed by the Russians some time ago, which is, understandably, not to our neighbours’ taste.

The Russians are offended that Belaruskali is hampering Uralkali from concluding a contract with China. A recent review by Raiffeisenbank reads: ‘It is not possible to raise the price by 10 percent under the new Chinese contract — to reach $335 per tonne’. Our producer is continuing to export fertilisers at the previous price of $305 but, as is traditional, ceased supplying on the eve of signing a new annual contract, to strengthen its negotiating position.

The Chinese contract price will serve as a guide for other markets and is huge in itself: worth 11-12 tonnes annually (despite mining approximately the same amount independently). Chinese buyers have agreed to add five percent to last year’s price (raising it to $320), rather than keeping the former price. Probably, they are concerned that Belaruskali will propose a lower price than the Russians, who wish to conclude a contract first.

Annual potassium demand should reach around 55-60m tonnes in 2015. If Belaruskali sustains its production at 10-10.5m tonnes, its market share will grow to 17.5 percent (from 16 today).

By Alexander Bogomazov